China and India still offer best single country options for Asia

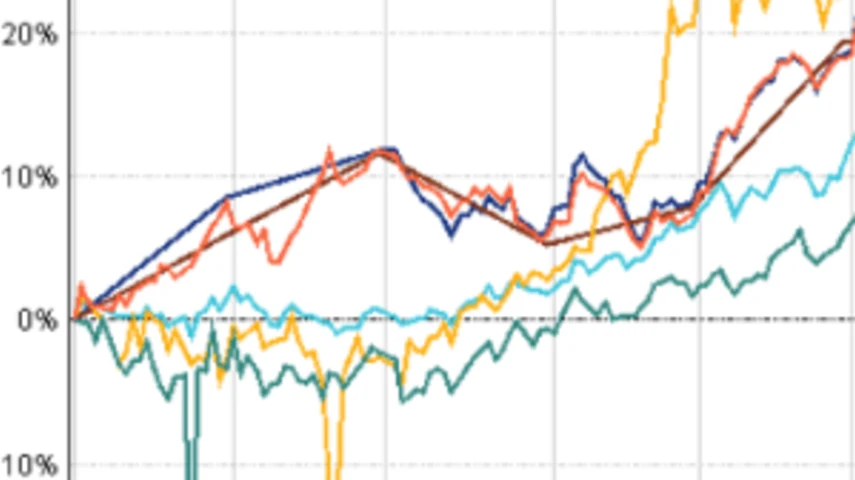

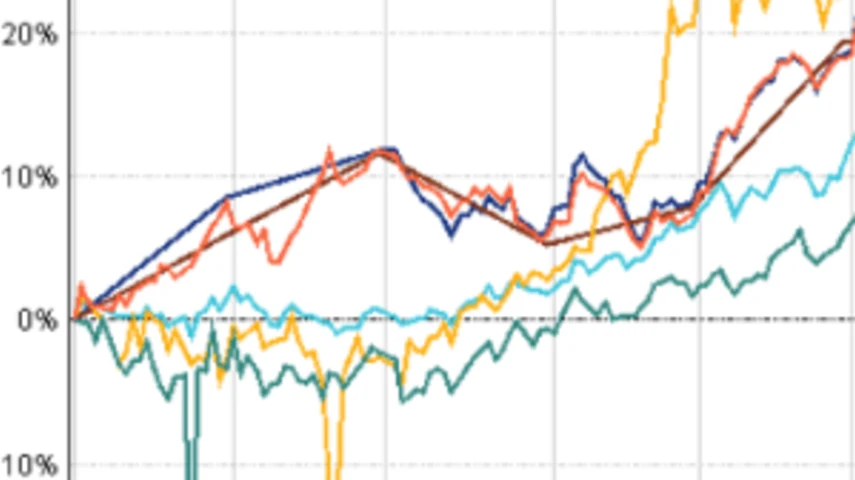

A China exchange traded fund (ETF) offered the best returns in the ACS Equity – Asia Pacific Single Country sector, but India had the most successful offerings over the year to 31 October, 2019.

According to FE Analytics, the best performers were VanEck Vectors ChinaAMC CSI 300 ETF (26.32%), Jaipur AM Master (25.05%), BlackRock iShares MSCI Taiwan ETF NAV (22.7%), Ellerston India (21.74%) and Fidelity India (21.44%).

The best performing Japanese equity fund was Platinum Japan P which returned 17.55%, eighth best overall in the sector.

Out of the 12 funds that achieved higher than the sector average (15.11%), six were from India, three from Japan, two from China and one from Taiwan.

VanEck Vectors ChinaAMC CSI 300 ETF covered the China Securities Index, which aimed to replicate the performance of the top 300 stocks in the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

The BlackRock iShares MSCI Taiwan ETF was the best performing for Taiwan, and the only non-China, India or Japan fund in the top 10.

Over half the Taiwan fund (54.75%) was dedicated to information technology, with financials (19.76%) and materials (9.16%) the next largest sector holdings.

Taiwan Semiconductor Manufacturing (24.18%) was its largest equity holding, with the next highest being Hon Hai Precision Industry, otherwise known as Foxconn (5.44%), as of 31 October, 2019.

The top holdings for Ellerston’s India fund as of 31 October, 2019, were Reliance Industries (16.2%), Housing Development Finance Corp (8.2%), Hindustan Unilever (8%), Tata Consultancy Services (8%) and Aix Bank (5.8%).

Fidelity India’s top holdings as of 31 October, 2019, were Reliance Industries (9.8%), Housing Development Finance Corp (6.9%), HDFC Bank (6%), ICICI Bank (5.6%) and Axis Bank (5.1%).

Although the Fidelity India fund had 56 holdings in the portfolio, the top 10 funds accounted for 52.6%.

Top five performing funds in the ACS Equity – Asia Pacific Single Country sector one year to 31 October, 2019.

Recommended for you

After introducing its first active ETF to the Australian market earlier this year, BlackRock is now preparing to launch its first actively managed, income-focused ETF by the end of November.

Milford Australia has welcomed two new funds to market, driven by advisers’ need for more liquid, transparent credit solutions that meet their strong appetite for fixed income solutions.

Perennial Partners has entered into a binding agreement to take a 50 per cent stake in Balmoral Investors and appoint it as the manager of Perennial's microcap strategy.

A growing trend of factor investing in ETFs has seen the rise of smart beta or factor ETFs, but Stockspot has warned that these funds likely won’t deliver as expected and could cost investors more long-term.