AREIT sector set to offer solid returns in 2020

The Australian real estate investment trust (AREIT) sector, which delivered a strong performance in 2019, is expected to continue to offer investors solid returns in the coming 12 months should bond yields remain low, according to SG Hiscock & Company’s director and portfolio manager, Grant Berry.

However, Berry warned, investors should not expect the 2020 returns to match those from last year and should be quick in recognising emerging risks such as the market’s late stage in the investment cycle.

“For the past two years, we have been at an advanced stage in the property cycle, particularly for commercial office and industrial property sectors,” he said.

Further to that, 2019 which saw geopolitical issues weigh heavily on global markets created an interesting year for Australian property market and its subsectors. Given the interest rate cut by the Reserve Bank of Australia (RBA) 2019 turned out to be ‘accommodative’ and provided a favourable backdrop for property, Berry said.

However, looking forward the firm would take a fairly conservative approach to valuations pushing up capitalisation rates.

“Our preference will be b to have exposure to high quality assets, AREITs with less cyclical factors, and investments trading at discounts that are out of favour.

“The recent shift towards value, with some reduction in risk behaviour, has seen this approach start to outperform while continuing to deliver good absolute returns.

“2019 has been a relatively good year for the AREIT sector, with strong returns including distributions and, looking ahead, if bond yields stay around current levels, we would expect the sector to be well supported.”

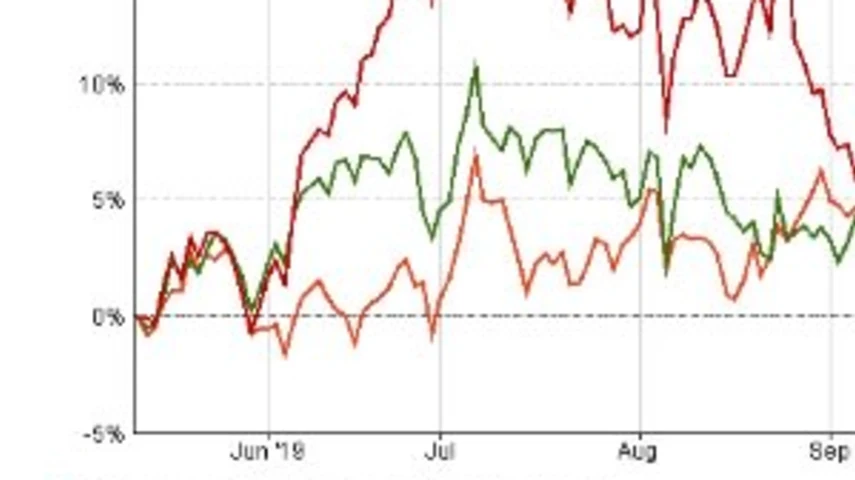

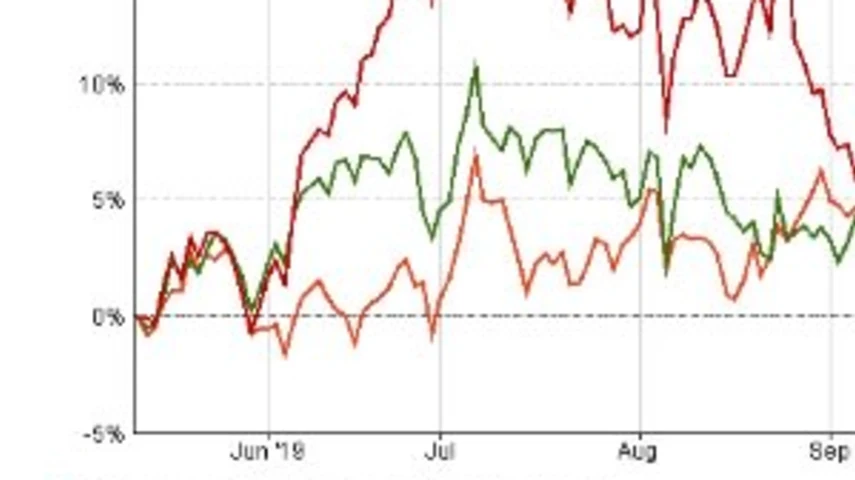

AREIT indices performance since inception

Recommended for you

Morningstar Australasia is scrapping its controversial use of algorithm-driven Medalist ratings in Australia next year and confirmed all ratings will now be provided by human analysts.

The dominance of passive funds is having a knock-on effect on Australia’s M&A environment by creating a less responsive shareholder base, according to law firm Minter Ellison.

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.