O’Dwyer again blames bad advice for FASEA creation

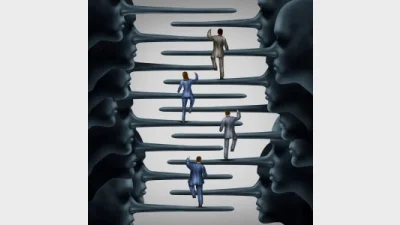

The Minister for Revenue and Financial Services, Kelly O’Dwyer has reiterated that the Financial Adviser Standards and Ethics Authority (FASEA) is the product of planners having delivered persistently bad advice.

At the same time as confirming the release of the latest transition pathways guidance by FASEA, O’Dwyer repeated her assertion that planners needed to remember why FASEA had been necessary – “repeated instances of inappropriate or just plain bad advice has significantly eroded trust and confidence in the financial advice sector”.

“Every adviser has a role to play in rebuilding that trust, and these new educational requirements are a critical step towards professionalising the sector,” she said.

“Ultimately, the professionalisation of the advice sector will be in the best interests of all advisers, existing and new, because it will ensure enduring consumer trust and confidence in the financial advice sector.”

Recommended for you

The Australian Financial Complaints Authority has reported an 18 per cent increase in investment and advice complaints received in the financial year 2025, rebounding from the previous year’s 26 per cent dip.

As reports flow in of investors lining up to buy gold at Sydney’s ABC Bullion store this week, two financial advisers have cautioned against succumbing to the hype as gold prices hit shaky ground.

After three weeks of struggling gains, this week has marked a return to strong growth for adviser numbers, in addition to three new licensees commencing.

ASIC has banned a Melbourne-based financial adviser who gave inappropriate advice to his clients including false and misleading Statements of Advice.