Advice key to retirement confidence

Australians who use a financial planner/adviser are three times more likely to feel "very well/fairly well prepared" for retirement, while significantly lower numbers believe they will rely on the Age Pension, according to a whitepaper.

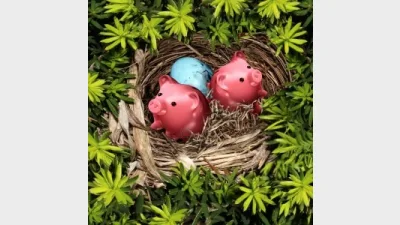

The final part of MLC's three-part whitepaper, ‘Australia Today', found that only 15 per cent of Australians felt confident about their retirement nest egg, while 66 per cent of those who had not retired were "slightly or not at all prepared" for retirement.

However, those who sought professional advice were significantly more likely (35 per cent) to feel well prepared, compared to those who did not seek advice (nine per cent).

Furthermore, only 27 per cent of over 2,000 respondents who used a financial planner/adviser, and 31 per cent of those who used an accountant said they were or would rely on the Australian Government in their retirement, compared to 49 per cent of those who did not seek professional financial advice.

Wealth Advice executive general manager, Greg Miller, said Australians remained uncertain about their retirement savings despite a robust superannuation system, and highlighted the effect of political tinkering of the super system.

"If we can get policy certainty around super, advisers will be better able to help more Australians understand the value of super and saving for their retirement," he said.

The research also found 74 per cent of women felt unprepared for retirement, compared to 57 per cent of men, which corresponded with the fact that they retired with 40 per cent less super than men.

Young people aged 25 to 29 were also more likely to feel unprepared (79 per cent).

Recommended for you

As the end of the year approaches, two listed advice licensees have seen significant year-on-year improvement in their share price with only one firm reporting a loss since the start of 2025.

Having departed Magellan after more than 18 years, its former head of investment Gerald Stack has been appointed as chief executive of MFF Group.

With scalability becoming increasingly important for advice firms, a specialist consultant says organisational structure and strategic planning can be the biggest hurdles for those chasing growth.

Praemium is to acquire an advanced technology firm for $7.5 million, helping to boost its strategy to be a leader in AI-powered wealth management.