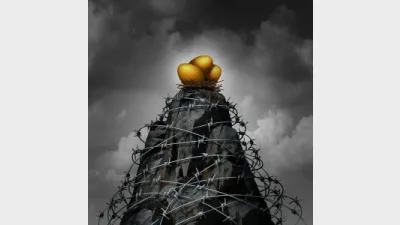

Super critical to overcoming under-insurance

For most Australians the insurance they have in their superannuation is the only life insurance they hold, according to the Association of Superannuation Funds of Australia (ASFA).

In a submission to the Productivity Commission's draft report on the Superannuation Competitiveness and Efficiency, ASFA has warned against under-estimating the importance of insurance within superannuation, particularly as a delivery mechanism for overcoming Australia's broader under-insurance problem.

"Insurance in superannuation is crucial as it addresses some of the effects of underinsurance in our economy and provides protection against the financial hardships that can be caused by disability or premature death," the submission said.

"Generally, insurance in superannuation is at a lower cost than insurance held outside superannuation, and it is much easier for people to obtain cover as policies are provided on a ‘group' basis rather than being individually underwritten."

"For most Australians the insurance they have in their superannuation is the only life insurance they hold. Insurance needs to be considered more broadly than just on cost and considered through the lens of ensuring that members receive appropriate protection for a reasonable cost," it said.

"The purpose of insurance in superannuation is, in effect, to cover the ‘future service' period between the event (disablement or death) and retirement age, to put the member (or beneficiaries) back in the approximate position they would have been but for the occurrence of the event."

"The full benefits of life insurance within superannuation, for individuals and the government, need to be considered," the submission said.

"KPMG has estimated that the total level of underinsurance with respect to premature death in Australia is $800 billion. Underinsurance in relation to death, total and permanent disablement, and income protection costs the government over $1 billion per annum in additional social security payments."

"This figure would be much higher without insurance in superannuation given the majority of cover across all of these insurance types is held through superannuation. Thus, there are material positive external benefits for the Government and the economy from life insurance being provided within superannuation."

Recommended for you

ASIC has commenced civil penalty proceedings in the Federal Court against superannuation trustee Diversa Trustees, regarding the First Guardian Master Fund.

The winners have been announced for the 2025 Super Fund of the Year Awards, held in Melbourne on 26 November by Money Management's sister brand Super Review.

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.