SEA an option for comfortable retirement

Retirees could find a comfortable retirement in moving to South East Asia if they are affected by the Age Pension assets test on 1 January, 2017, a financial services executive believes.

Connect Financial Services Brokers chief executive, Paul Tynan, said if a solution to the assets test did not appear on an approved product list, model portfolio, or planning software, professional indemnity restrictions would not allow planners to articulate other alternatives.

"Some estimates say the Age Pension assets test could have as many as 200,000 pensioners receive lower part pension payments and benefits from January next year and up to 100,000 lost pension payments altogether," Tynan said.

"It's a frightening scenario and problem for retirees with some very tough decisions needed on how best to stretch restricted savings and income."

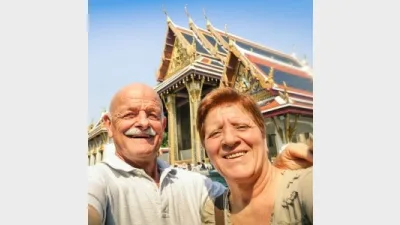

Tynan suggested that retirees and mature age Australians could live a better life in a South East Asian destination like Indonesia, Thailand, and Malaysia.

"This will not be the retirement solution for every retiree, however, Australians in growing numbers will explore this option in the years to come. Living in Malaysia will allow Australians to maintain current living standards in their later years as cost of living increases erode retirement nest eggs," he said.

"Health care and aged care in Malaysia is much more affordable when compared to Australia."

Tynan said retirees could keep their financial assets in Australia and access money through ATMs and banking institutions.

"…seniors are very fortunate with options many in overseas countries don't have and although I acknowledge that relocating offshore will not suit everyone because of family ties and unwillingness to adapt to a different culture and way of life — there are those with an adventurous spirit that will see this as an exciting financial chapter in their lives," he said.

Recommended for you

ASIC has released the results of the latest financial adviser exam, held in November 2025.

Winners have been announced for this year's ifa Excellence Awards, hosted by Money Management's sister brand ifa.

Adviser exits have reported their biggest loss since June this week, according to Padua Wealth Data, kicking off what is set to be a difficult December for the industry.

Financial advisers often find themselves taking on the dual role of adviser and business owner but a managing director has suggested this leads only to subpar outcomes.