ASIC cracks down on debt firms’ false advertising

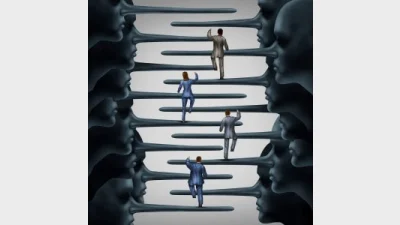

The Australian Securities and Investments Commission (ASIC) has issued an infringement notice to a debt resolution firm and ordered two others to remove misleading advertising as part of its crackdown on false advertising by debt resolution firms.

Capital Debt Solutions Australia Pty Ltd has been issued a $10,800 infringement notice, while Debt Assist Aust Pty Ltd and Bankruptcy Experts Pty Ltd have removed misleading statements online.

ASIC raised concerns that Capital Debt Solutions had false claims on its website stating the firm was trusted and recommended by over 6,000 Australians. ASIC said there was no evidence for the figure and deemed the advertising misleading.

The firm and Debt Assist Aust have also removed false online statements after ASIC found their debt agreements were not “government approved”.

The regulator also found debt solutions firm, Bankruptcy Experts had testimonials on its website that were unable to be substantiated.

ASIC deputy chairman, Peter Kell, said misleading advertising was damaging for consumers.

“'Firms must ensure their marketing materials and promotional statements are based on fact,” he said.

“Recommendations and statements, like 'government approved' can have a strong influence when vulnerable consumers in financial hardship are seeking help with their debts.”

Recommended for you

An adviser has received a written reprimand from the Financial Services and Credit Panel after failing to meet his CPD requirements, the panel’s first action since June.

AMP has reported a 61 per cent rise in inflows to its platform, with net cash flow passing $1 billion for the quarter, but superannuation fell back into outflows.

Those large AFSLs are among the groups experiencing the most adviser growth, indicating they are ready to expand following a period of transition and stabilisation after the Hayne royal commission.

The industry can expect to see more partnerships in the retirement income space in the future, enabling firms to progress their innovation, according to a panel.