Investors know that the past three years have been bad for US government bonds. But few have fully appreciated how bad. Spelling things out: 2022 was the worst year ever for US treasuries. The 10-year treasury – the bond of greatest interest to financial markets, as it forms the basis of the “risk-free rate” – provided a one-of-a-kind return of -18% for the calendar year.

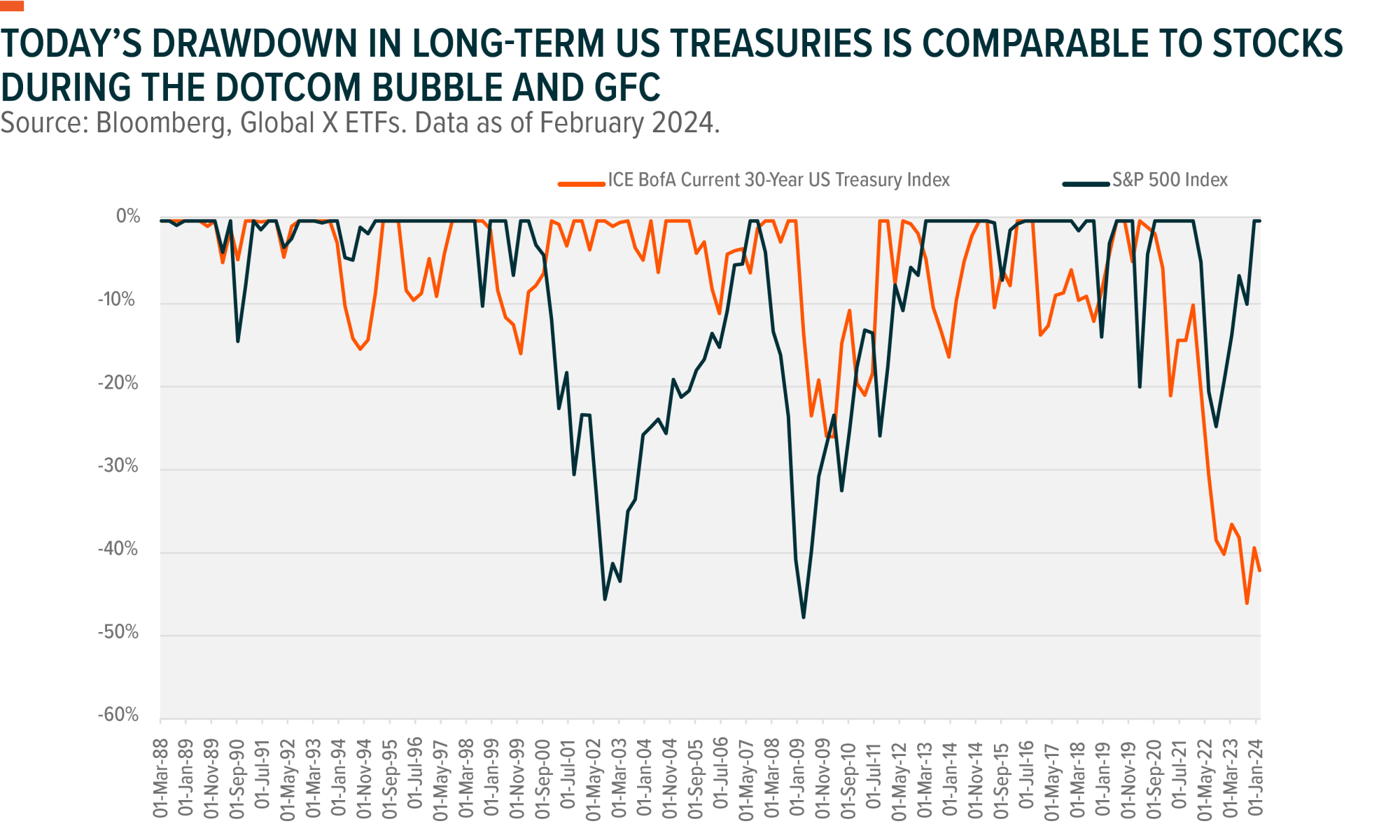

Looking at 30-year treasuries, which are more sensitive to inflation expectations, things look worse. Long duration US treasuries are now in an almost 50% drawdown. This compares to the selloff stocks experienced during the dotcom collapse in 2000 and the financial crisis in 2008. We can see this in the graph below.

Income opportunities look good

These drawdowns have been painful for bondholders. However, with prices where they are today, there are opportunities. In particular, treasuries now pay attractive income – especially compared to stocks.

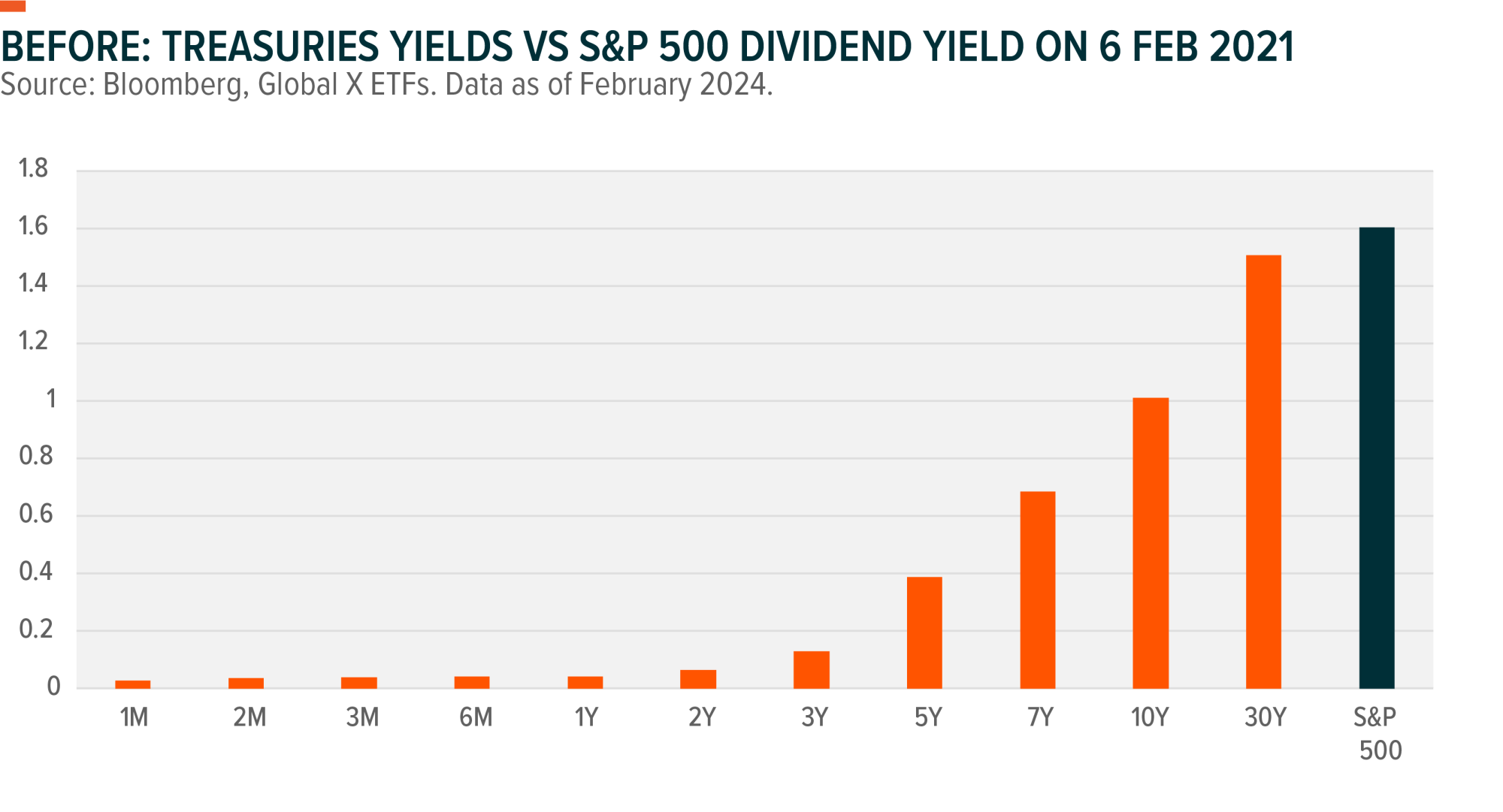

In the aftermath of covid-19, as central banks sent interest rates to zero, treasuries offered little income. The S&P 500’s dividend yield bested that on even 30-year treasuries. A feat quite remarkable considering US tax laws disincentivise dividend payments (many US companies prefer buybacks, which are more tax-effective).1

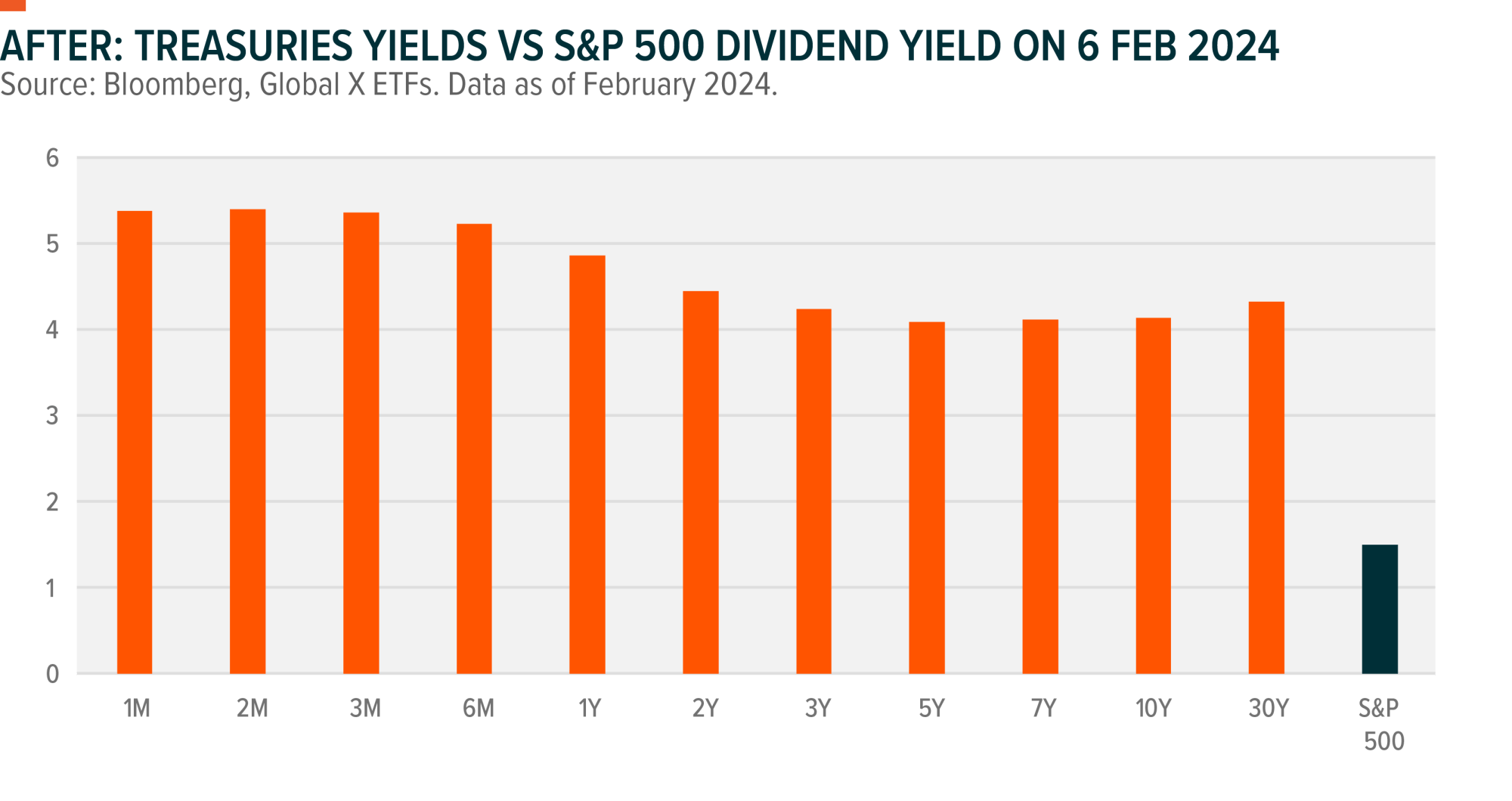

Today by contrast, US treasuries across the curve offer nearly triple the yield of the S&P 500. And as the payments (coupons) treasuries make are fixed, investors can lock in the yield until the bond matures. They do not have to worry about variability in the way they do with dividends.

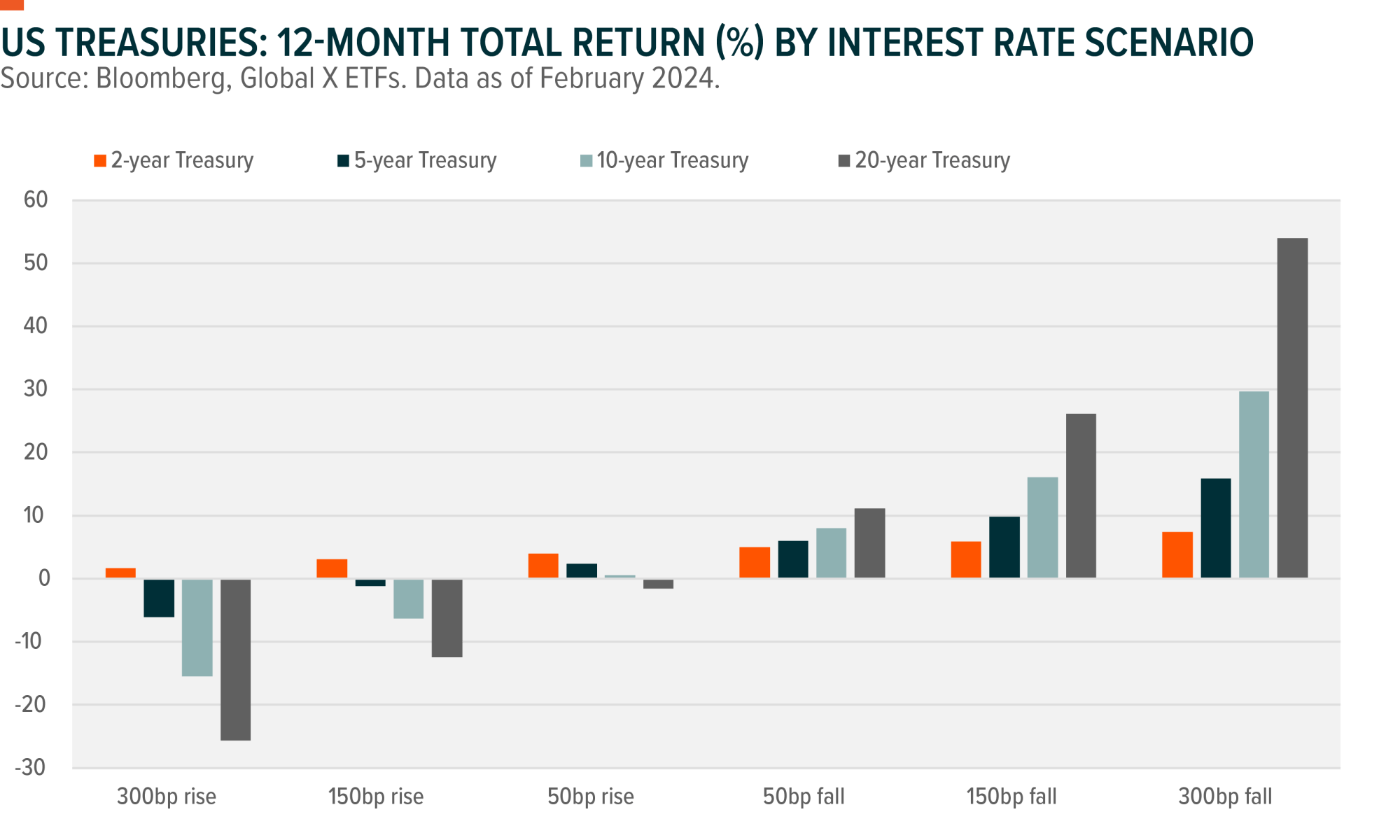

As an added bonus, the lower prices and higher yields mean that treasuries are now offering what’s called “cheap positive convexity”, in the jargon. What’s that? To shortcut the math and rough over the detail, the bigger coupons that treasuries now pay means that their prices can go up faster than they can fall. And should interest rates fall, treasuries will generate bigger capital gains than equivalently rising interest rates will create losses. This is reflected in the graph below, which shows how 2-year US treasuries make a gain even if rates rise 300 basis points.

Is now really the time?

Investors inclined to buy treasuries in today’s market may still ask about timing. What has fallen can fall further; what is cheap can get cheaper. Sticky inflation and a strong labour market may work to keep rates high and bond prices low.

Yet from our perspective, the worst of inflation is likely over, and the US labour market is showing signs of deterioration.

Investors usually use treasuries for income and capital stability. Yet a painful reality is that investors who bought them during covid have received neither. Coming into 2024, however, the battlefield looks quite different. And those looking to fixed income for income have never had so many options.

Explore Global X’s range of Beyond Ordinary Income ETFs.

1https://budgetmodel.wharton.upenn.edu/issues/2023/3/9/the-excise-tax-on-stock-repurchases-effects

Disclaimer

This document is issued by Global X Management (AUS) Limited (“Global X”) (AFSL 466778, ACN 150 433 828) and Global X is solely responsible for its issue.

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

Brokerage commissions will reduce returns. Past performance information is not an indication of future performance.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.