Macro forces are increasingly putting China on a different trajectory from its fellow emerging markets economies.

What does this mean for how you should invest in emerging markets for the future?

Structural transitions and regulatory change taking place in China’s economy mean that growth continues to be challenged. At the same time, emerging market (EM) economies outside of China may benefit from some of the key ‘mega forces’ driving long-term market returns, such as demographics and AI.

Taking all this into account, it may make sense to have the flexibility to gain exposure to China and the rest of EM as separate allocations in the current investment climate.

China- Different macro themes playing out

When it comes to index investment into EM, China has a large gravitational weight. It makes up almost a third of the MSCI EM Index (up from 20 per cent a decade ago), and more than half of the index’s 1,335 names. Yet looking at China’s significance in global markets, it makes up just over 3 per cent of the MSCI All Country World Index.

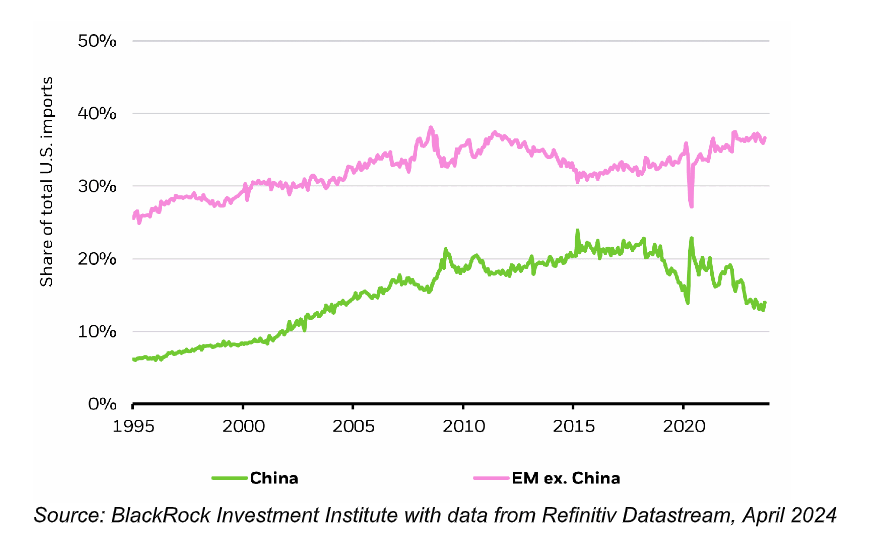

At the same time as China’s significance as a component of EM has risen, its growth has been challenged by various factors, including structural transitions taking place in the economy and strict regulations. China’s share of US imports has shrunk to less than 15 per cent as trade tensions between the two nations continue to simmer, while its share of working age population has been declining since 2010.

In the shorter term, Chinese consumers continue to be cautious and hold on to a greater proportion of savings in the post-pandemic era, while it is not clear whether a host of government stimulus measures will be effective in reversing the downturn in its property market.

While these challenges may well create investment opportunities in time, it suggests China may need to be viewed in a different way by investors – and potentially segmented from the rest of EM, so investors can scale up or down their exposure to China depending on their view of the opportunities and risks in the Chinese market.

Treating the two regions separately may also reduce volatility across the portfolio. By looking at both the three and five-year time periods, the MSCI China index has exhibited a standard deviation of 30 per cent and 27 per cent respectively, compared to 18 per cent and 19 per cent for the MSCI Emerging Markets index.

This indicates significantly higher volatility coming from China. BlackRock analysis also shows that excluding China entirely from the MSCI World index and reallocating that exposure to EM ex-China would boost risk-adjusted returns across one, three and five-year time periods.

EM ex-China: Where are the opportunities?

Emerging market economies are positioned to benefit from some of the key ‘mega forces’ driving the lion’s share of growth opportunities in today’s investment landscape. The most dominant of these forces in recent months has been artificial intelligence, where Taiwan is a leader: almost 15 per cent of its GDP is derived from technology, and the locally headquartered Taiwan Semiconductor Manufacturing Company (TSMC) currently the world’s largest producer of semiconductor chips.

With geopolitical fragmentation on the rise and the global economy splitting into competing blocs, markets such as commodity-rich Brazil – with its valuable resources and supply inputs, as well as a diverse export base across Asia, Europe, and the Americas – are also well-positioned to benefit.

Demographic change will also likely play a role in long-term growth as markets with younger populations claim an advantage, in addition, the share of the population that is working age in India is set to overtake China by 2030 so we expect demographics to act as a tailwind for the region.

Economies that make up the EM ex-China index typically derive around 70 per cent of their revenue from other EM markets (including China), and the slowdown of growth in China has been somewhat of a positive force for these economies.

Disinflationary forces have meant central bank authorities are more inclined to cut interest rates, in comparison to developed markets where rate cuts may still be months off.

This combination of positive macro forces has been reflected in the strong performance of the MSCI EM ex China Index, which returned over 15 per cent in the year to May 2024, compared to around 12 per cent for the broad EM index which does include China.

Longer term, EM ex-China has also outperformed broader EM, returning 6.5 per cent for the five years to May versus 3.5 per cent for broader EM.

Getting granular

A modular approach that splits EM and China allocations allows investors to pivot more nimbly as tactical opportunities arise. One option is to replace the traditional EM exposure with a proportionate combination of China and EM ex China exposures, which resembles the broader EM including China index but provides a ‘lever’ to over-or underweight China based on the market outlook.

Using ETFs as building blocks, it’s easy to take this approach while keeping portfolio costs low and taking advantage of the liquidity of the ETF structure to respond rapidly to market events.

Depending on your own investment views, it’s possible to adjust and blend your allocation to EM economies through a combination of broad EM, EM ex-China, Chinese equities, and EM fixed income.

With macro forces likely to lead to decidedly different outcomes for China versus the rest of EM, we believe having the ability to be more dynamic and selective with opportunities across these markets could be valuable.

Tamara Stats is lead iShares ETF specialist at BlackRock Australasia.