In the wake of recent industry-wide change financial planning numbers appear to have moved little, according to data collected for the Money Management Top 100 Dealer Group Survey. However, as Jason Spits reports, there has been plenty of change below the surface with planners on the move at both the institutional and boutique ends of town.

The past twelve months may become known as the year in which everything changed but still all looked the same.

The Future of Financial Advice (FOFA), heralded in 2011, postponed in 2012 and implemented in 2013, has not created a massive ground shift of advisers fleeing the industry nor has it created a schism breaking the financial planning sector in two clearly defined camps of aligned and non-aligned. However, that may yet happen given current events surrounding advice offered by some institutionally-aligned planners and Government and public pressure for more root and branch changes.

In terms of the numbers of financial planners currently operating within the sector, the Money Management Top 100 Dealer Group Survey for 2014 has shown that while planner numbers have remained consistent since last year’s survey they have not remained static, with planner movements between licensees still active.

The consistency of the overall numbers is not initially evident in the total number of planners reported in 2014 Top 100 with the figure of 15,069 planners well down from last year’s figure of 16,368 planners.

However Money Management asked survey respondents to specifically separate out ‘non-advice giving’ authorised representatives from ‘advice giving’ authorised representatives. In doing so, it was found that nearly 900 people were being reported as involved in financial planning but not necessarily considered as being a financial planner.

At the same time a number of groups chose not to respond with planner numbers for 2014 leading to a further 400 planners being omitted from the survey this year. Taken together these numbers come to a total of only 30 short of last year’s figure.

The real movement is below the surface of this headline number with a number of groups posting significant additions and subtractions of planner numbers.

Westpac Financial Planning added 390 planners – the single biggest increase in the this year’s survey – but this came at the expense of advice stable-mate St George which lost 403 planners – the single biggest decrease in the survey. The second biggest decrease was that of Morgans who dropped 378, however this was the result of the group separating out planners from stockbrokers (See About the Top 100 on page 14).

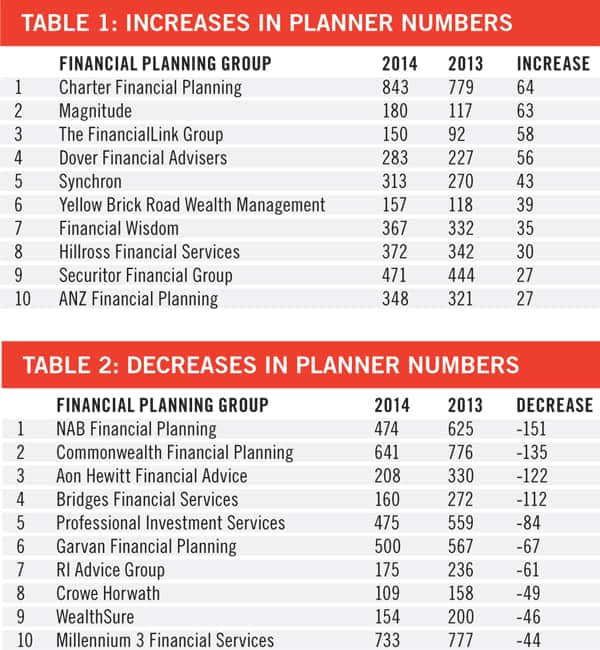

Putting those particular shifts aside the next largest increase in adviser numbers was that of Charter Financial Planning which grew by 64 from 779 planners to 843. Charter also posted the largest gain of financial planners in last year’s survey, adding 296, well ahead of this year’s increase.

BT’s Magnitude also added about 60 planners as did The Financial Link Group which had its numbers boosted after advisers with Titanium Planners moved across to the Peter Daly led group. Synchron also continued to attract advisers at a solid clip, adding 43 this year compared with last year’s addition of 50 advisers, to sit at 313 planners in 2014.

Yet while there were some solid gains by planning groups across the Top 100 only 36 groups actually reported growth in planning numbers. The impact of FOFA and the ‘wait and see approach’ to grandfathering was reflected in the gain experienced by the Top 10 fastest growing groups who only added 442 planners compared with 891 in 2013 (Table 1).

The level of decline among the Top 10 shrinking groups remained consistent with a decline of 871 among the 10 groups compared with 706 in 2013. Like-for-like comparisons are difficult with these numbers as only five of the 10 planning groups in this set this year also featured in it last year.

NAB Financial Planning and Commonwealth Financial Planning both appeared in last year’s ‘bottom 10’ and shed 151 planners and 135 planners, respectively and 200 planners and 175 planners over the past two years, respectively.

In fact institutions figured heavily in the fastest shrinking groups dropping 692 planners collectively with 520 of those planners dropping away from the top four fastest shrinking groups alone (Table 2).

Groups that had their numbers reduced to zero by being merged with other licensees include AMP-owned Quadrant and Strategic Planning Partners which were folded into Genesys Wealth Advisers and Ipac, respectively. Commonwealth Bank owned Whittaker Macnaught and WB Financial Management were both folded into Financial Wisdom while IOOF-owned SMF Wealth was folded into Consultum.

These mergers effectively mean that more brands will disappear from the planning sector as institutions, and boutiques, seek to rationalise costs involved with multiple brands, licenses, compliance and back-office regimes. It also changes the ranking of groups within the Top 100.

While last year’s survey saw the Top 10 groups by planner size containing the same names as 2012’s survey – albeit in different positions – this year’s highest ranking groups have been shaken-up.

AMP Financial Planning, Charter, Millennium 3 and Commonwealth Financial Planning all retain their top four positions unchanged while Count and Professional Investment Services moved up a number of places as does Securitor and Hillross, off the back of declines in other planning groups.

However the single largest ranking change is that of Westpac Financial Planning, leaping into ninth from 54th, due to the shift of St George planners. Garvan falls from sixth to 13th with 346 planners after a decision within NAB to once again separate Garvan planner numbers from those of MLC Financial Planning, which re-enters the Top 100 for the first time in 9 years at 29th with 154 planners.