In recent years the financial planning sector has emphasised the value of advice to the general public but what has been the value of the adviser to their practice and their licensee?

The growth of the planning sector and the space occupied by institutions who own financial planning groups would indicate there is some intrinsic value in having financial planners on the books.

Cynics would suggest the institutions find value in having large scale planning groups as a way to push product and to charge a range of fees and commissions for advice.

Other commentators would suggest the value of a planner is in the advice they provide and the end benefit derived by the client over many years.

Unfortunately the first measure is often quoted, sometimes without context, while the second is hard to quantify across many thousands of advisers and millions of clients over years and possibly decades.

However the Money Management Top 100 Dealer Group Survey does allow an insight into which planners offer the best value to their licensee by an examination of funds under advice per adviser and per client.

The first thing evident from such an examination is that only about 60 per cent of planning groups are willing or able to supply current funds under advice data. The second issue is that even less – around a third of planning groups – are willing or able to supply client numbers.

Some groups who did respond to this request stated they would not supply this information for commercial reasons but a majority chose to leave those fields vacant when returning the data related to their group.

Of those who did return funds under advice data, AMP Financial Planning continued to lead the field, as it does with the number of financial planners.

Macquarie Private Wealth – who were in second place in this category last year chose not to supply any data – and were replaced by Commonwealth Financial Planning with Westpac Financial Planning taking third.

In fact institutionally aligned planning groups dominated the top 10 planning groups for funds under advice with three AMP aligned groups, two Commonwealth Bank aligned groups and one NAB and one Westpac group taking seven out of 10 places in that set. The field was rounded out by Perpetual Private Clients and two non-institutionally aligned groups – State Super Financial Services and Shadforth Financial Group.

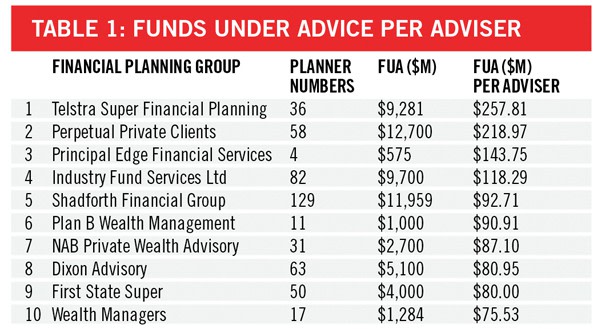

However these numbers are quickly changed when considering the level of funds under advice per adviser with only four institutionally aligned planning groups ranking in the top 10 and only nine such groups in the top 20.

At the head of pack is Telstra Super Financial Planning with $257 million of funds under advice for each of its 36 planners followed by Perpetual Private Clients with $218 million of funds under advice for each of its 58 planners. Boutique planning firm The Principal Edge, while boasting only four planners, has funds under advice per planner of $143 million well ahead of IOOF’s Plan B and Wealth Managers planning groups and NAB’s Private Wealth advisers (Table 1).

Another measure of an adviser’s value may be that of how many clients does each planner service on average. Such an examination of the Top 100 data results in IOOF’s Wealth Managers ranking as the hardest working planners in the survey with 2314 clients per adviser. NAB owned Meritum Financial Group runs second with an average of 930 clients per adviser, while ClearView Financial Advice runs third with 897 clients per adviser.

In assessing this data there are some necessary caveats to be made and chief among them is that the planning groups in the Top 100 have different advice models and make contact with clients in different ways, ranging from low scale advice through to high-end bespoke private client services.

At the same time groups who provide advice to industry and corporate superannuation funds, via trustee services and under group advice arrangements may list large numbers of clients but not necessarily provide advice to them all.

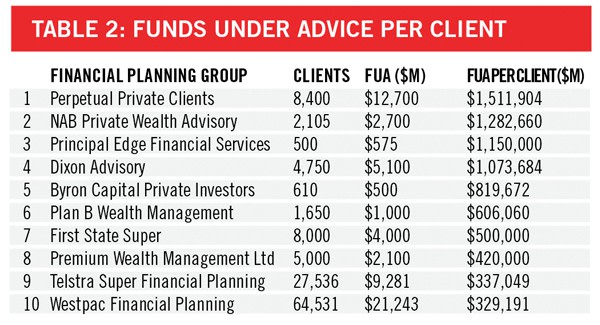

However the best measure of the worth of a planner may not actually be the planner themselves but the underlying net worth of the clients they service, because at the end of the advice process is the client who expects their personal wealth to grow as a result of the advice provided.

In that case a consideration of funds under advice per clients shows that private client, boutique and mid-tier non-aligned planning groups hold the best value clients in this year’s Top 100.

Leading this group are two private client advisory business – Perpetual Private Clients and NAB Private Wealth, followed by boutique businesses The Principal Edge and Dixon Advisory which can all claim to have an average client worth of more than $1 million. The remaining top 10 planning groups by client worth only contain two institutionally aligned groups – Plan B Wealth Management and Westpac Financial Planning. Two super fund related business – Telstra Super and First State Super – and two boutiques – Byron Capital and Premium Wealth Management make up the other places (Table 2).