The demand for financial planning businesses for sale isn’t decreasing, and the flood of planners selling post Royal Commission and FASEA isn’t eventuating as quickly as expected – because industry policies continue to change.

Previously a 1 January 2026 date led to a flurry of enquiries from potential vendors, however the current state of events has reduced this. Advisers are sitting waiting, watching to see what happens.

Brokers have long lists of interested acquirers, meaning businesses aren’t necessarily advertised anymore – instead going to a shortlist of acquirers who are known to have execution-ability (the ability to execute a transaction – funding, know how and time/people to manage a transaction).

Previously the list of financiers was whittling, with NAB and Macquarie the main banks involved, however with new entrants, such as Judo Bank, smaller transactions are getting off the ground as NAB and Macquarie prefer larger transactions, and tripartite agreements with licensees.

Pre 2023, debt was cheap and the option to take cash off the table, reducing the buy-in price for internal incoming equity holders was attractive. Even buying a financial planning business was cheaper, with debt previously seen at 3-4 per cent per annum.

What does this all mean for the valuation of your financial planning business in 2024, you may ask?

Valuing a financial planning business

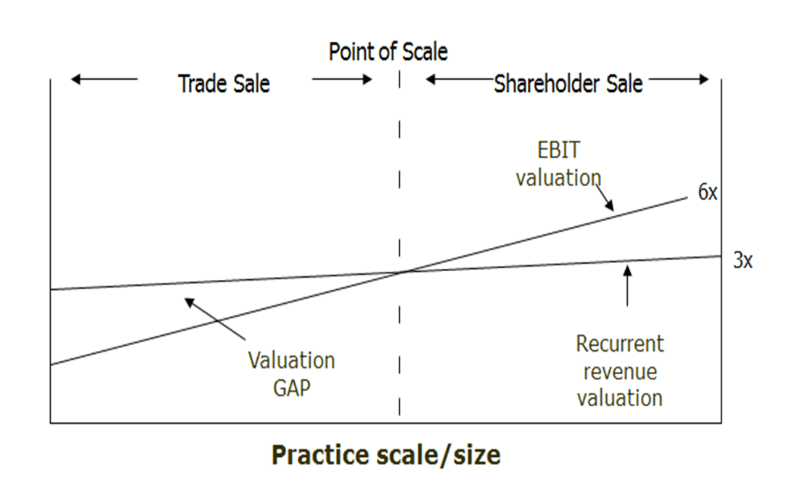

There remain two main methodologies to value a financial planning business, that is a multiple of earnings before interest and tax (EBIT) or a multiple of recurring revenue. There is a clear divide on which methodology suits in certain circumstances.

The profitability, future maintainable earnings, or EBIT methodology is relevant where a shareholder is investing in a business. The profit is what pays a dividend to reduce debt on the purchase. Similarly, a sophisticated purchaser is going to review the incremental profit the acquisition generates and consider this in the scheme of their own valuation.

A recurring revenue methodology is used in some ‘bolt-on’ transactions. That is where a client base is acquired, and the servicing of those clients is largely absorbed by the acquirer, with little to no costs being transferred. In these cases, this can be appropriate, however we have also seen this go terribly wrong when an acquirer transferred a few staff members, paying a recurring revenue multiple and essentially extending their payback period of the acquisition to over 12 years (usually acquisitions would be paid back in 6-8 years).

Merging businesses are considering the profit each party brings, any synergy benefits, and how this sits from a percentage contributed by each party.

Let’s look at the methods, and current multiples, in a little more detail.

-

Method 1 – EBIT Multiple

The EBIT methodology, also known as future maintainable earnings, or profitability based valuation, considers the normal ongoing profit of a business. This is adjusted for any one off or non-commercial income or expense items. We want to consider the profit an arm’s length purchaser would obtain from buying this business.

The most common adjustments we see in smaller financial planning businesses are:

- Market salaries – It is common for sole traders, or small businesses, to pay family members for tax purposes, or pay themselves lower or higher wages for certain circumstances. We need to consider a market wage, that is if I employed you to operate this business – what would I pay you?

- Run Rate – with most financial planning revenues received on a monthly basis, a new client signing on in May is only going to have 2/12 months of revenue received in a financial year. We need to consider the current run rate of revenue (e.g. if that revenue was received for a 12 month period). This is relevant for new clients, and even those repricing clients ongoing fees.

We see a variance in the profitability of financial planning businesses, with scale a main driver of this. Scale is the point at which we would expect the recurring revenue valuation and future maintainable earnings valuation to intersect, and where the practice can extract a benchmark profit. With the increase in licensing fees and staffing costs, the point of scale has increased over the last few years and is now approximately $1.6-1.8 million in revenue.

This depends on a number of variables, including location, and how the business is operated – e.g. offshoring, I.T, etc. Benchmark profit is approximately 40 per cent with buyers suspicious of profit margins much above a 45 per cent margin, it is not seen as sustainable long term, with key person risk, burn out etc.

There is material investment required to achieve any further profit. The average profit margin for a practice, not yet at scale, is anywhere from 10-30 per cent.

-

Method 2 – Recurring Revenue

The recurring revenue valuation is still commonly referred to in the industry, and well known sources publish multiples on a regular basis. These days, a purchaser reviews a client list, or buckets of client revenues, and allocates multiples based on age and client fee. A client under $3,000 or over 70 years old is likely to attract a lower multiple than a 55 year old with a $6,000 ongoing fee.

Other factors come into play with these multiples, including location of the client base (a discount will apply for regional clients).

Whilst the market discusses a client base being sold at 3 times recurring revenue, it is unusual to see a blanket multiple applied, and usually an averaging effect brings the multiple down. We have seen transactions where the tail end of a client book has dragged the recurring revenue multiple below a two times recurring revenue. In this circumstance, a conscious effort was made to dispatch with the bottom of the client book and a repackaged client base was put to the market, attracting a normal market multiple (still being customised by client by the purchaser).

Chart 1: EBIT Methodology and Recurring Revenue Intersection

What drives a business valuation higher?

In both a recurring revenue and profitability-based valuation, there are conscious actions a business owner can take to improve their business valuation.

These include:

- Having strong client reporting, including age and fee per client group (husband and wife being one person), e.g. the client base is segmented and can be reported on in a timely manner.

- Having a minimum ongoing fee, and a structure to determine the cost to serve attached to this fee (e.g. is the fee profitable)

- Maintaining strong computer systems and up to date software. It is daunting to think of an adviser still having paper files, but there are still firms that are not operating in a digital environment.

- Structured clients on like platforms and a client value proposition that is replicable under a new adviser.

- A multi-team member approach, where the client is used to dealing with other advisers or client service administrators, reducing the key person risk and potentially allowing a team member to continue on past your retirement, ensuring a smooth transition for your clients (and talent for the acquirer – a positive in an environment with strong demand for quality staff.

- Succession plans can contribute to your business valuation as they show strategic planning, e.g. reducing key person risk.

How are firms maximising their opportunity?

It used to be that the highest sale price was one completed in a market transaction, likely at a recurring revenue multiple. These days, we are seeing more and more firms complete internal succession plans where they introduce equity to key employees over time, bringing the team member along for the journey, and selling equity at points along the way – perhaps where certain metrics or KPI’s are met. This can achieve as high a price but provide a greater feeling of satisfaction to the vendor that their legacy lives on.

With any process, be it an internal or external process we find that the firms who start focusing on their business valuation, and future succession planning, tend to have a more positive result, maximising their value and reducing their risk along the way. The market sale approach these days often stretches from 6 months to 12 months with information gathering, due diligence and contracts.

There is no such thing as a good, quick sale.

Fiona Ettles is a partner of FinConnect Advisory Group