Recent market reckonings have led to a renewed focus on identifying investment strategies that can better deliver optimally diversified portfolios to weather financial storms and provide more balanced growth.

We contend the framework of Alternative Risk Premia (ARP) investing merits a closer look. This investment approach aims to blend various market-risk premia (such as buying winners, selling losers, and buying cheap and selling expensive) to generate an uncorrelated stream of returns.

Such strategies offer a flexible diversification framework that can enhance risk-adjusted returns, whether used as overlays or standalone strategies.

In this article, we’ll provide a brief history of the development of ARP investing, tracing it from the academic foundations to its modern incarnations being employed by practitioners today.

CAPM and the discovery of risk premia

The journey to understanding ARP investing begins in the 1960s with the Capital Asset Pricing Model (CAPM). This foundational financial model sought to demonstrate that an investment’s expected return is related to its systematic risk, represented by the market premium over the risk-free rate. This meant that every asset’s expected return could be compared both within the wider market context and evaluated on a fundamental basis.

Despite critiques, the CAPM remains a critical tool in finance, used in everything from corporate finance to portfolio optimisation. However, as further research was conducted, it became evident this singular perspective of risk and return did not explain many return ‘anomalies’ that were regularly exploited by market participants. Research by academics like Eugene Fama, Kenneth French, and Mark Carhart identified additional risk factors, such as value, size, and momentum that drive asset returns.

Building portfolios based on these identified factors has become known as risk premia investing or factor investing. Factors can be thought of as quantitative definitions of securities characteristics that drive returns. For example, the term value risk premia classically describes shares in companies that are trading at low valuations relative to historical earnings or book value. An investor exposed to value risk premia would expect to earn an excess return relative to the market from this cohort of stocks as some of these companies valuations recover.

The taxonomy of risk premia

Once academics harnessed the full power of computers to analyse returns, the number of identified risk premia grew rapidly. Today, ARP managers can take exposure to numerous differentiated premia and trading signals when constructing portfolios. Many of these can be applied both at the micro level of individual securities and at the asset class level. Below, we share a few examples of different risk premia:

- Quality – Quality risk premia describes a strategy of gaining exposure to high-quality assets that exhibit strong financials, stability, and positive fundamental characteristics. This approach aims to capture the excess returns generated by high-quality companies or assets with reliable earnings, solid balance sheets, and strong competitive advantages.

- Momentum – Momentum as an ARP strategy that exploits the persistence of price trends in financial markets. It involves identifying assets that have shown recent price movement trends that are expected to continue in the short to medium term. Investors following a momentum strategy seek to benefit from the phenomenon of “momentum” or the tendency of assets that have exhibited upward price trends to continue rising, and assets with downward price trends to continue declining.

- Carry – Carry is an ARP strategy that focuses on capturing the return generated by interest rate differentials or yield spreads across various assets. It seeks to exploit the concept of “carry” which refers to the potential profit gained from holding an asset with a higher yield or interest rate relative to another asset with a lower yield or interest rate. Carry strategies can be applied to currencies, fixed income securities, commodities, and other financial instruments.

Risk premia correlation – the holy grail of investing

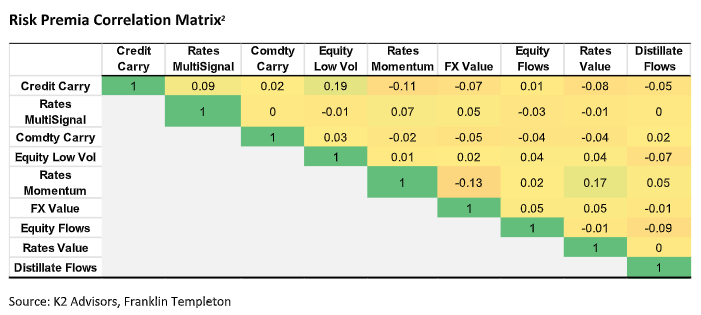

The most important result of the academic and practitioner classification of risk premia was the ability to track and measure each premia’s magnitude, persistence and, crucially, their correlation. Through rigorous analysis, market practitioners discovered that the returns derived from distinct risk premia displayed a remarkable lack of correlation with one another.

This discovery marked a pivotal moment in risk premia investing because of how it intersected with the work of Harry Markowitz, the Nobel laureate who had pioneered Modern Portfolio Theory.

In the 1950’s, Markowitz introduced the world to the concept of portfolio diversification, underpinning it with mathematical rigor. His key insight was that by combining assets that were not perfectly positively correlated, investors could significantly reduce the riskiness of their portfolios.

Markowitz’s findings boiled down to the idea that in choosing a portfolio, investors should look not

just at the expected return of each individual security but at the risk adjusted return instead.

Markowitz’s work appeared long before the markets became aware of alternative risk premia, but for those in the know, the implications of his investment framework for this new trove of uncorrelated assets was clear; anyone who could combine these return streams would be able to create a highly diversified and potentially unique portfolio of return streams.

Removing beta – Mimimising market risk

The final hurdle investors faced to access this profoundly differentiated portfolio was the market itself. For most of financial history, to access many of these risk premia it was necessary to take not only exposure to the risk premia itself but also the wider market.

For instance, those buying value stocks were not only accessing the value risk premia but also the underlying beta of the market. Yes, you might earn an excess return from the value risk premia by owning value stocks, but this incremental excess return would be dwarfed by the risk assumed by the wider stock market. This would leave the investor like the proverbial man or woman picking up pennies in front of the steam roller.

To create an intelligently risk-weighted portfolio using risk premia, it was necessary to find a way to remove the market return component. If successful, the beauty of this approach would be its precision – investors could measure risk premia, quantify them, and harness their return streams without taking on unnecessary market risks.

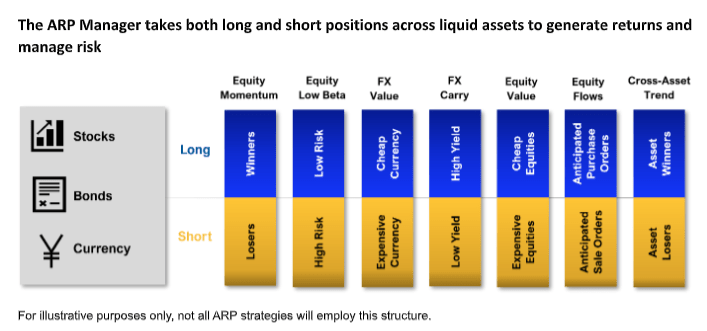

The solution that enabled truly modern ARP portfolios was a combination of classic long/short portfolio positioning and the use of derivatives that allowed investment managers to benefit from their leverage, liquidity, and access to asset classes beyond stocks and bonds.

Enhancing ARP cash management & precision with derivatives

The final piece of the puzzle was put in place by combining the power of the long/short positioning with the customisation and flexibility of derivatives including futures, forwards, and swaps. Using these investments allowed for a level of customization and flexibility that was unprecedented.

For many types of ARP, the investment manager could now decide to tailor their exposure at either a macro (the level of an index) or the micro level in which they choose the individual stocks, bonds or currencies that they felt represented the best exposures.

The marriage of long/short exposure and derivatives added a further dimension to the management of ARP portfolios through the more targeted use of leverage. This is because it allowed managers control over notional exposure of any given risk premia, allowing them to fine-tune their risk and manage the expected volatility and return of each exposure. The result was a more sophisticated, template upon which to build better risk-weighted and risk managed portfolios.

Alternative risk premia today – A modern approach to building diversification

The evolution of ARP strategies, characterized by increasing sophistication, systematic approaches, active management, and a keen focus on risk management, has opened new avenues for investors seeking to diversify their portfolios and enhance risk-adjusted returns.

However, its power lies not in its ability to replace traditional market exposures, but in its capacity to complement them. ARP strategies offer a unique stream of returns that is less correlated with the business cycle, and therefore, both equity and fixed income markets. This characteristic is particularly valuable in today’s complex and volatile financial landscape, where the traditional diversification benefits of both stocks and bonds can quickly evaporate in certain market conditions.

As we navigate the financial markets in the uncertain decades ahead, the principles of ARP investing will gain increasing recognition for their role in building optimised client portfolios.

These are:

- Diversification

- Systematic analysis

- Systematic portfolio management augmented with episodic discretionary oversight;

- Disciplined risk management

By incorporating ARP strategies into an allocation, investors can access a well-diversified return stream, one that is grounded in academic research and honed by practical application. One that has the potential to provide a much-needed buffer against market volatility, enhancing the portfolio’s resilience in the face of financial storms.

Paul Fraynt is head of direct trading and quantitative investment strategies for K2 Advisors, part of Franklin Templeton.