Active management in fixed income remains a compelling strategy, leveraging market inefficiencies to generate excess returns and manage risk, often more effectively than passive alternatives.

Some investors believe that the best approach to investment is always via a low-cost passive strategy, as they assume that active managers structurally underperform once fees are factored in.

While this perception can hold true in equity markets, fixed income markets tell a different story. Structural inefficiencies, market fragmentation, and passive investing distortions create opportunities for skilled managers to outperform, and many active managers meaningfully beat their benchmarks even after fees.

This means investors need to look for managers with a robust investment process that are able to achieve consistent net of fee outperformance by navigating the risk and opportunities.

Active managers do generally add value in fixed income

Many investors contend that active managers struggle to outperform their benchmarks across all asset classes. While this can hold true for equity strategies, the same cannot be said for fixed income. In contrast to equities, fixed income markets tend to be less efficient and transparent, creating opportunities for active managers to outperform benchmarks and generate excess returns.

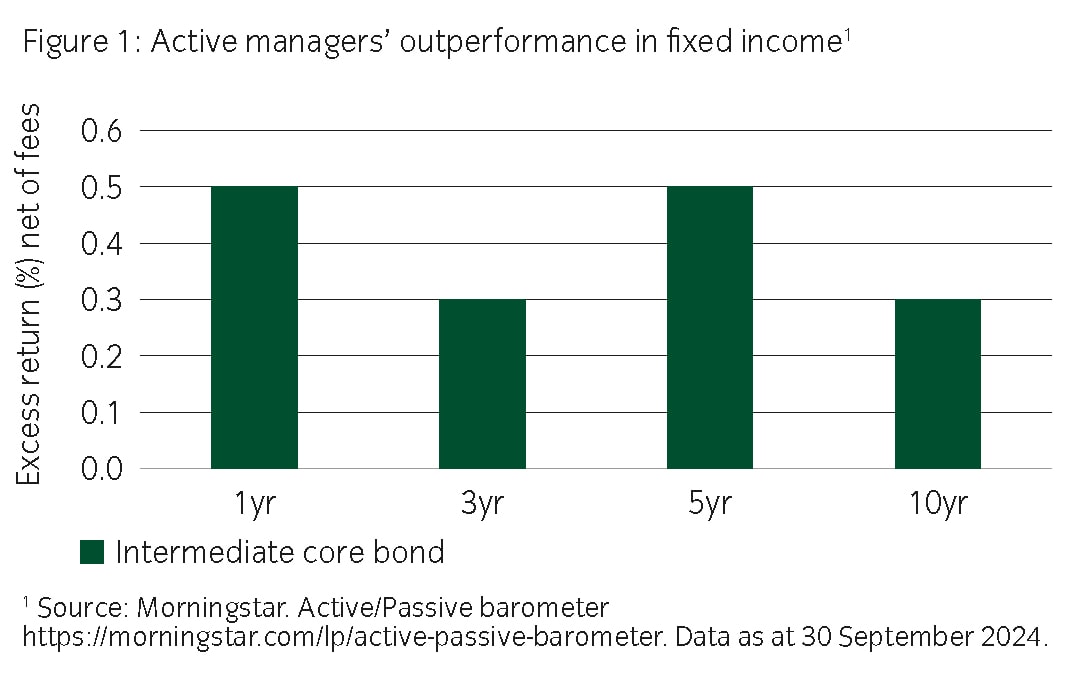

These inefficiencies are further amplified by the rise of passive investing. Consequently, data from Morningstar shows that active managers have historically generated long-term returns well above their passive counterparts in intermediate core bond portfolios, which typically hold a mix of US government bonds and investment grade credit.

Beating benchmarks and exploiting inefficiencies

Fixed income managers employ a range of strategies to add value in fixed income through different market conditions. This includes strategic portfolio positioning based on interest rate expectations, and fundamental credit analysis to identify mispriced securities whose valuations fail to reflect their current and future fundamental strength or weakness.

Market fragmentation also provides further inefficiencies to exploit, allowing managers to select optimal bonds based on personal risk appetite across universes of bonds that extend to tens of thousands. Active managers, importantly, have the flexibility to adjust their credit exposure, and can take on higher or lower credit risk compared to the index, based on these preferences.

Whole industry sectors in fixed income markets can sometimes be mispriced, often due to sector-specific economic cycles or excessive leverage. Unlike passive strategies, active managers can be flexible enough to avoid investing in these sectors ahead of time but then increase exposure when they believe the risks are in the price.

The hidden risks of passive investing

Investors in fixed income should be aware of the shortcomings of many traditional fixed income indices when pursuing an investment strategy.

Unlike equity indices, which favour the largest and most successful companies, fixed income indices are skewed toward the most indebted issuers – both corporate and sovereign – often leading to instances of poor diversification and excessive concentration in highly leveraged sectors or countries.

Moreover, passive strategies are inherently reactive. Bonds drop out of many indices as they approach maturity or are downgraded below investment-grade status, forcing passive funds to sell at inopportune times, particularly during economic downturns.

This challenge for passive investors is further compounded by the fact that investment grade indices are increasingly dominated by BBB-rated bonds, as companies have taken on greater leverage, while the highest quality AAA and AA-rated bonds now represent less than 10 per cent of the market.

Compounding these risks, passive bond funds face ongoing transaction costs and rebalancing inefficiencies, which structurally hinder performance relative to actively managed alternatives.

Volatility is the friend of active managers

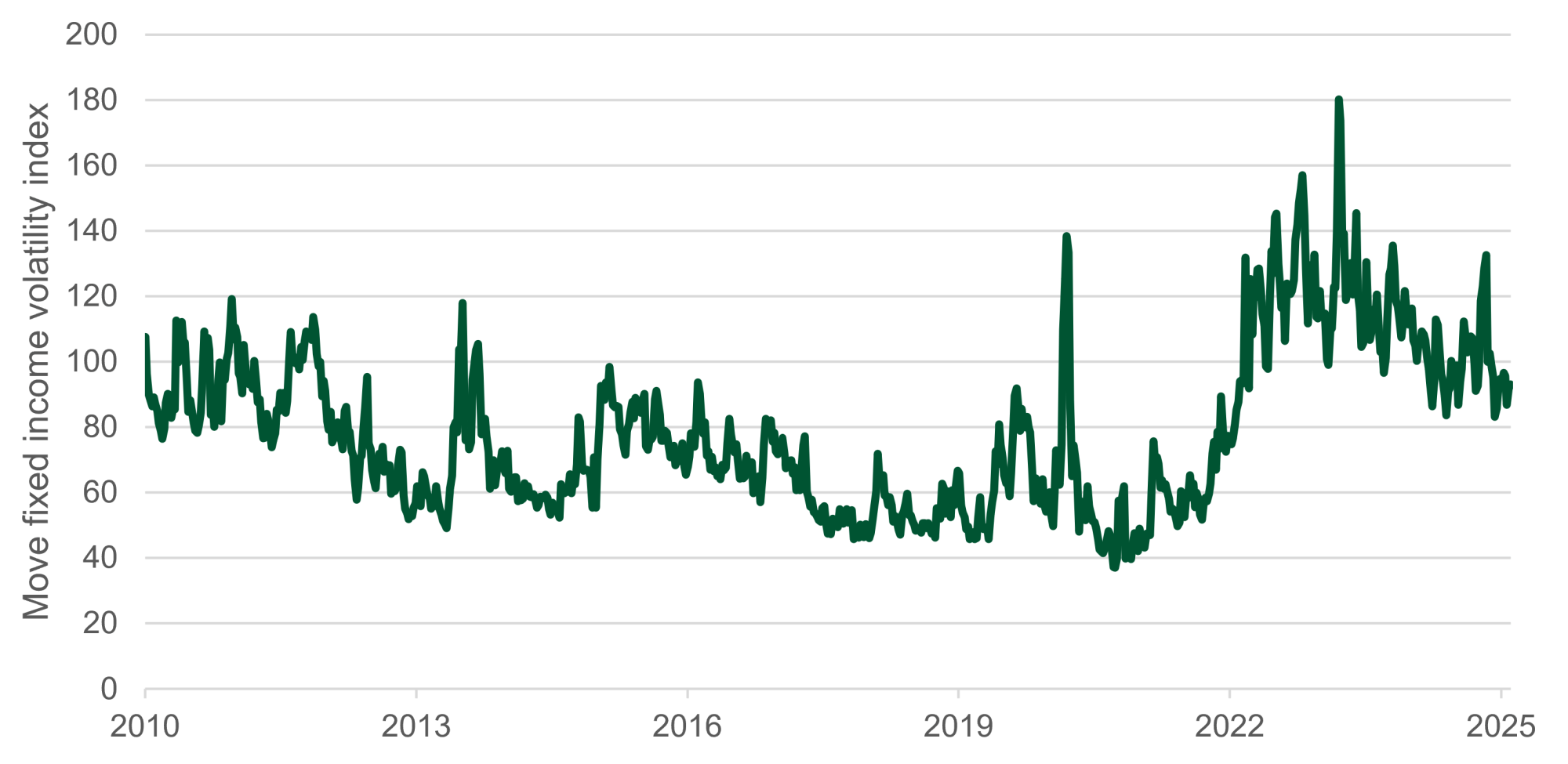

Bonds are misvalued more frequently during periods of market volatility, and sharp market moves can create valuable opportunities for active managers with robust investment processes.

Bond market volatility has grown markedly in the last few years, driven by the COVID-19 pandemic and the rise in interest rates since 2022. We believe that this heightened volatility is likely to persist due to the evolving macroeconomic backdrop, plagued by higher interest rates, geopolitical instability, deglobalisation and fiscal looseness.

Flexible active managers generally tend to benefit from this environment since volatility often equals opportunity, creating the ideal conditions to exploit mispricings.

Over the 12 months to end December 2024, returns and volatility across major fixed income segments diverged significantly. Notably, US high-yield credit delivered higher returns with lower volatility than expected. This is an example of how markets can defy conventional wisdom.

A flexible active manager can work to pinpoint the drivers behind these trends and position portfolios accordingly, turning volatility into an advantage.

Winning by not losing

For investors focused on safe and reliable cashflows rather than return maximisation, active managers play a crucial role. Skilled managers can identify undervalued securities, construct a diversified portfolio, and steer clear of issuers at risk of default or credit deterioration.

The case for active management

The case for active management in fixed income is clear. Bond markets present unique inefficiencies that active managers can exploit, whether by identifying mispriced securities, adjusting credit exposure dynamically, or proactive sector rotation.

Market volatility, structural flaws in traditional bond indices, and the limitations of passive strategies further reinforce the importance of active decision-making. However, careful manager selection is crucial in ensuring a robust investment process that delivers repeatable above benchmark returns over time.

Adam Whiteley is head of global credit at Insight Investment.