The combination of earnings stability and inflation protected earnings means infrastructure is uniquely positioned for the world we face today, where inflation remains stubbornly high and recession risk lurks.

By investing in listed infrastructure operators, such as electricity networks, toll roads, and other essential assets and related services, investors gain exposure to predictable long-term earnings streams. This earnings stability has historically enabled the asset class to deliver clear benefits including:

- Inflation-linked

- Low correlation to global equities and fixed income

- Income generation

- Lower volatility than alternative asset classes

Why infrastructure now?

Infrastructure companies are often regulated or subject to contracts that last for many years, which have levers in place to factor in Consumer Price Index (CPI). These contracts may stipulate how and when prices increases are passed on to consumers.

Similarly, the long-term contracts and the monopolistic and inelastic nature of infrastructure often means the asset class is less exposed to volatility. Even when economies are under pressure, people still need to travel to work on toll roads, heat their homes and businesses and consume water. This gives infrastructure companies rare resilience in their earnings profile.

Over the longer term, the demand for infrastructure is expected to grow significantly, as populations increase and societal needs change. As a result, global listed infrastructure also has robust growth prospects. Global listed infrastructure offers diversification in unpredictable times, while delivering reliable income and protection from inflation.

The diversification advantage

When reviewing asset class options, too few investors focus on infrastructure in the allocation process, in our view. Instead, they tend to focus primarily on debt and equity and build other allocations around those two asset classes, in our view.

The Lazard Global Listed Infrastructure portfolio seeks total return by investing in a select universe of ‘preferred infrastructure’ companies that we believe can achieve lower-volatility returns that exceed inflation, presenting a potential diversification opportunity due to the mix of different infrastructure assets it contains.

The portfolio may be a powerful complement to real assets, private equity infrastructure, and global equity allocations. Infrastructure can also offer characteristics that we believe are well suited to the current macro

environment: potential inflation hedging, earnings resilience, and diversification.

Inflation protection properties in public equity markets

In an inflationary environment, infrastructure can play a key role in portfolios. This is because return targets are often set relative to inflation—our global listed strategy, for example, aims to generate 5 per cent over CPI over a market cycle—and we believe listed infrastructure assets can offer the best inflation protection properties available in public equity markets.

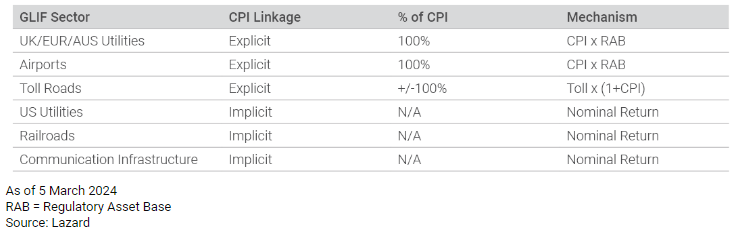

Because the degree of potential inflation protection varies significantly by company, selection is crucial. Based on our analysis, less than 25 per cent of listed infrastructure companies can potentially offer true inflation protection. Within that 25 per cent, the level of protection varies. Some have explicit (direct) inflation pass-through, while some have implicit inflation protection, depending on the terms of the underlying service contracts.

Exhibit 1 depicts the general inflation protection levels of listed infrastructure stocks by sector.

Infrastructure’s link to inflation: How select infrastructure assets factor in CPI

UK, European, and Australian utilities, airports, and toll roads have historically had direct, explicit inflation pass-through: The contracts on these assets tied payments directly to the rate of inflation.

US utilities, railroads, and communication infrastructure returns, however, have historically been implicitly linked to inflation. US utilities’ earnings levels, for example, are typically set by regulators with a view to long-term interest rate assumptions, but these can move away from the CPI for periods of time until the regulators adjust the return levels. By contrast, US railway owners overall can set prices, and satellite companies typically establish fixed prices under long-term contracts.

Earnings resilience

As regulated monopolies providing essential services, Preferred Infrastructure assets—assets that we believe are best identified using a highly selective approach—typically enjoy highly inelastic demand profiles. Moreover, with very high operating profit margins and stable regulated returns, profits have been relatively protected from any given decline in revenues arising from economic stress.

The earnings of utility companies or toll road operators have historically been more resilient than those of the average industrial stock in a recession: While consumers may cut discretionary spending in a downturn, for the most part, they typically still turn on the lights or travel by car.

A stable earnings profile has also helped lead to a consistent yield premium for infrastructure over broader developed market equities.

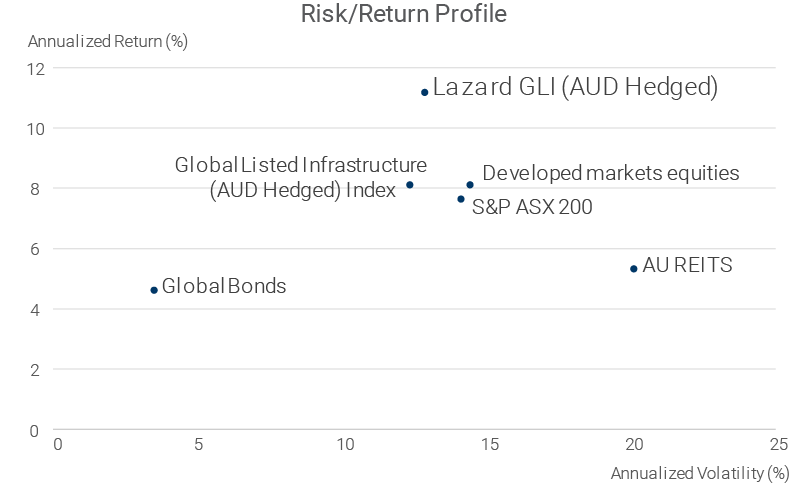

Based on MSCI index data from November 2005 through December 2023, listed infrastructure has occupied a position mid-way between equities and fixed income on the risk-return spectrum.

Over time, it has had low return correlations to most other asset classes in addition to lower volatility than the broad equity markets. These attributes mean that infrastructure can potentially provide diversification within an investment portfolio overall, within an equity allocation, or alongside private equity in an infrastructure allocation.

Looking at risk-return over the last 19 years, Exhibit 2 shows that while the MSCI World Infrastructure index has demonstrated lower risk compared with the global equities index (MSCI World), it has come at the expense of return relative to developed market equities.

We believe listed infrastructure is an asset class where a selective approach from an active manager can add considerable value.

Stable returns and income

Railways, roads, airports, and utilities form the backbone of modern society. Thanks to their reliable earnings history, many investors have turned to listed infrastructure securities in search of stable returns and income.

We believe listed infrastructure can potentially provide a contractual inflation linkage in cash flows, stable returns through economic cycles, a low risk of capital loss, ‘rising coupons’ through real earnings growth, and, finally, diversification benefits via low volatility and low correlations to other asset classes. In our view, the benefits of the asset class are best achieved by taking an active, selective approach—one that combines valuation discipline with strict criteria for selecting companies.

Warryn Robertson is portfolio manager at Lazard Asset Management.