For the first time in 30 years, investors are facing an environment of persistent inflation. We have seen consumer prices rise, and stay elevated, due to a combination of fiscal and monetary stimulus packages to support economies that were locked down during the COVID-19 pandemic, supply chain disruptions, and recent geopolitical events. The Federal Reserve has responded with a series of interest rate increases that are expected to continue into year-end.

Inflation and rising interest rates have resulted in losses across capital markets this year. Many bonds have static cash flows of interest payments and principal repayment. Inflation erodes the future purchasing power of those static cash flows. Bond prices are also highly sensitive to interest rates such that rising rates result in mark-to-market losses, which we have witnessed this year.

Long duration growth stocks, characterized by a current lack of profitability as they spend to grow their operations and gain market share, are also very sensitive to changes in interest rates. While these equities posted strong gains during the pandemic when rates were near zero in the U.S., they have slumped this year as the Fed tightened monetary policy. As a result, we have seen a rotation in leadership in the equity market from long duration stocks to less speculative names.

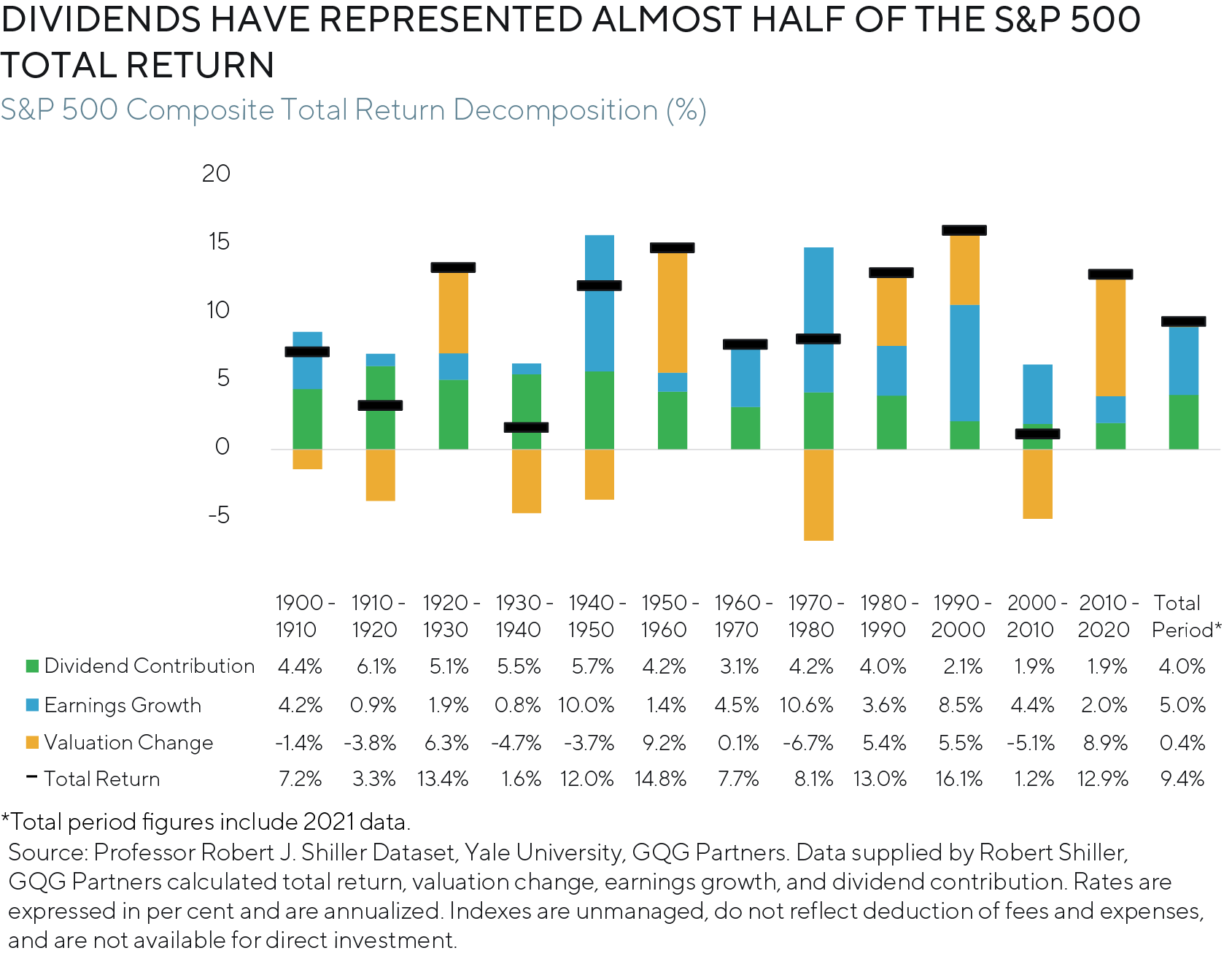

Meanwhile, during this year’s global market volatility, high dividend paying companies have been outperforming broader equity market indices due in part to the contribution to total return that dividends provide. At GQG Partners, we have long viewed dividend income as an important source of total return in an equity portfolio. In fact, from 1900-2021, dividends have contributed strongly to the performance of the S&P 500 Index – representing almost half of its total return.

Dividends play a key role in portfolios, in our opinion, and may help weather the storm of high inflation, rising rates, and a potential slowdown in global growth. We believe that our quality-first, forward-looking approach to dividend investing is worth revisiting.