Netwealth has posted strong half year results to 31 December 2018, with underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of $24.8 million, which is an increase of $4.3 million on the previous comparative period (PCP).

The platform provider’s underlying EBITDA margin saw an increase of 51.5 per cent, which is an increase of one per cent on the PCP, and its underlying NPAT increased $3.0 million to $17.0 million.

Netwealth’s total revenue also saw an increase of $48.2 million, and funds under administration (FUA) net flows for the half year were $1.9 billion, resulting in FUA of $19.0 billion at 31 December last year.

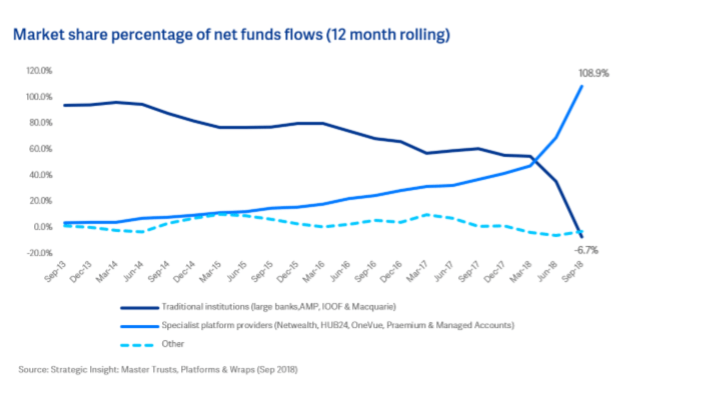

The chart below shows the market share percentage of net funds flows in a 12-month rolling period.

In a statement to the ASX, Netwealth said it expected to benefit from continued strong flows and growth in the overall platform market.

It also said many of the recommendations in the Royal Commission’s final report would lead to further growth of its core business, stating specifically that the phasing out of grandfathered commissions is expected to be a “positive impetus” for growth.

“Less than 3.5 per cent of Netwealth’s FUA is subject to grandfathered commission and the removal of grandfathered commission will not negatively impact Netwealth’s net revenue,” it said.

Netwealth also said it was well placed to provide functionality to support the increased compliance and regulatory requirements for licensees and advisers, and highlighted it had no residual liabilities in terms of advice.