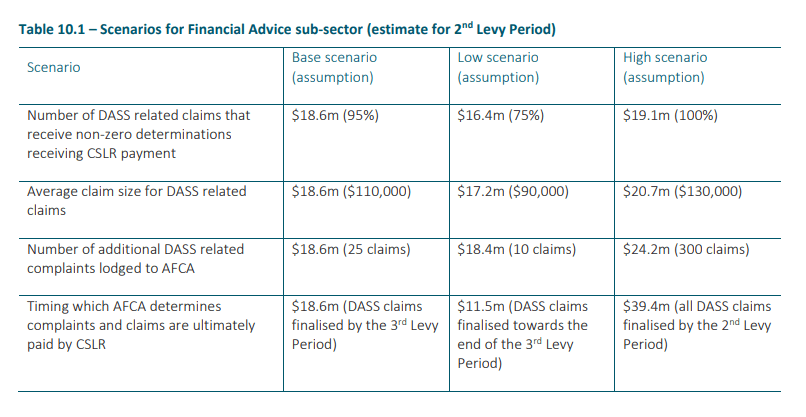

The Compensation Scheme of Last Resort (CSLR) second levy period for financial advisers could increase as high as $39.4 million if the Australian Financial Complaints Authority (AFCA) processes all DASS complaints by March 2025.

Last week, it was announced the second levy period for financial advisers will be $18.1 million, out of a total $24.1 million.

The majority of this relates to complaints regarding Dixon Advisory and Superannuation Services (DASS), described by the Financial Advice Association Australia (FAAA) as a “black swan” event which has resulted in almost 2,000 complaints to AFCA.

The “surge costs” involved in processing DASS claims have been allocated in their entirety to the financial advice sector, CSLR said.

The original $18.1 million estimate for advisers is based on an assumption by the actuaries compiling the estimates that:

- 95 per cent of DASS complainants will lodge a successful CSLR claim.

- The average DASS claim size will be $110,000.

- 43 per cent of post-CSLR complaints will have determinations by June 2025.

But, the report continues, it could end up rising as much as 114 per cent from this original estimate to $39.4 million if AFCA acts faster than expected to process claims.

AFCA already stated it has doubled the size of its team working on the complaints to cope with the increased workload.

“Before Dixon, AFCA had generally issued about 200 determinations a year in its investment and advice jurisdiction. AFCA has doubled the size of its investment and advice decision-making team and increased its case management workforce, among other steps in response to the flow of Dixon complaints,” it said last month.

The CSLR report said: “An outcome of the second levy period exceeding $18.4 million, for example, could plausibly result from AFCA processing complaints faster than anticipated in our determination patterns. We have assumed that around 43 per cent of post-CSLR DASS complaints will have determinations issued by June 2025. However, if AFCA is able to determine all DASS complaints by March 2025, then the second levy period amount could end up around $39.4 million.”

On the flip side, if AFCA takes longer than expected to process complaints, then the amount could reduce to $11.5 million, and the remaining complaints will tip over into the third levy period instead.

“Should determinations take an extra six months to complete, a material portion of DASS complaints will be finalised in the third levy period. This could result in a second levy period amount of $11.5 million.”

Source: CSLR, March 2024

Future advice firm failures

Putting the DASS claims aside, the report also stated it expects to see multiple financial advice firms fail each year compared to just one in each of the other three subsectors.

“Financial advice has the highest number of complaints per firm that are unpaid or unreported at the failure date. For this subsector, we have assumed 4.2 firms will fail on average every year, with an average of 11.6 complaints per firm, consistent with the historical experience.

“This means we expect 48.7 in-scope complaints to arise from financial advice firms that will fail each year.”

Complaints about financial advice have an average advice complaint outcome of $168,326, and receive on average $124,936.

However, the report admitted that no provision has been made for the failure of another major financial firm like DASS, which has been described by the FAAA as a black swan event.

“The occurrence of severe events, such as the failure of a major financial firm or a severe economic downturn could increase CSLR payments beyond our estimates in this report. No allowance is made for future severe events, noting the high level of uncertainty around the occurrence of these events in any one levy period and the scheme being designed to post-fund severe events.

“Our approach where there is uncertainty is to make reasonable estimates of outcomes in a reasonably favourable future environment. In particular, no allowance is included for the possibility of higher than normal failure rates or claim costs, even on an average basis.”

We must stand up and show our opposition to both the ASIC Levy and CSLR as they both contribute to the high cost of advice.

How do we influence political parties to counter the massive donations made by the banks?

If we are to succeed in influencing either party, you must do so at a grass roots level, for example we must attack Labor on Cost of Living as that is their Achilles heal right now.

The Liberal Party is also vulnerable on the same issue.

Unfortunately, our clients don’t necessarily believe that fees imposed on us will cause an increase in their fees. We know differently.

When we undertake reviews, we point out to our clients the high level of compliance we must undertake and the impact this has on their fees, however this will not change the voting intentions.

It is only personal safety, and the hip pocket nerve are the only ones that cause their vote to change.

Look at Queensland and you will understand why the Labor Government is in fear of losing office. In November 2024.

If we surveyed our clients and asked them which issues were important to them, I am sure that we would get a better understanding about the issues that really matter to them.

I urge all financial advisers to get behind the AIOFP in its efforts to influence both Labor and Liberals to reform our compliance nightmare.

Look at what Mortgagee Brokers achieved by being united.

To achieve a pollical outcome, we must offer our influence in exchange for what we want. This is what the Banks do and at present “The Banks tell the politicians to Jump and only response is How High”: The Banks buy these outcomes with donations…..

We cannot offer the Millions in donations; however, we may be able to offer either party Government.

Our clients are voters, and we have the capacity to influence them to vote one way or the other, by using our knowledge of what influences them.

Bennelong and Kooyong are good examples of our influence at work.

What can you do to help; Join the AIOFP and send a message to Canberra that we are united and a force to be respected.

William Mills Price Financial Intelligence

We must stand up and show our opposition to both the ASIC Levy and CSLR as they both contribute to the high cost of advice.

How do we influence political parties to counter the massive donations made by the banks?

If we are to succeed in influencing either party, you must do so at a grass roots level, for example we must attack Labor on Cost of Living as that is their Achilles heal right now.

The Liberal Party is also vulnerable on the same issue.

Unfortunately, our clients don’t necessarily believe that fees imposed on us will cause an increase in their fees. We know differently.

When we undertake reviews, we point out to our clients the high level of compliance we must undertake and the impact this has on their fees, however this will not change the voting intentions.

It is only personal safety, and the hip pocket nerve are the only ones that cause their vote to change.

Look at Queensland and you will understand why the Labor Government is in fear of losing office. In November 2024.

If we surveyed our clients and asked them which issues were important to them, I am sure that we would get a better understanding about the issues that really matter to them.

I urge all financial advisers to get behind the AIOFP in its efforts to influence both Labor and Liberals to reform our compliance nightmare.

Look at what Mortgagee Brokers achieved by being united.

To achieve a pollical outcome, we must offer our influence in exchange for what we want. This is what the Banks do and at present “The Banks tell the politicians to Jump and only response is How High”: The Banks buy these outcomes with donations…..

We cannot offer the Millions in donations; however, we may be able to offer either party Government.

Our clients are voters, and we have the capacity to influence them to vote one way or the other, by using our knowledge of what influences them.

Bennelong and Kooyong are good examples of our influence at work.

What can you do to help; Join the AIOFP and send a message to Canberra that we are united and a force to be respected.

William Mills Price Financial Intelligence

The problem with the 2017 Industry Funding Levy ACT on financial advisers and soon CSLR, is that most of the independent advisers do not handle clients’ funds where virtually all of the funds are invested through administration platforms since 2013, their ASIC AFS license prohibits these advisers from handling client funds, advisers have no fiduciary obligations in investment management operations and receive no investment management fees, but advisers are burdened with the Levy from self-dealing frauds and negligence by those who handle client funds. Government Legislation has got it wrong to abuse innocent advisers with their existing clients for more than 20 years. Platforms are raking in big administration fees and face no risks, but they have the deep pockets to pay CLSR, not financial advisers who are scratching for survival on ongoing adviser services client fees, where their only fiduciary obligation is to their clients, not to free underwriting the Commonwealth Treasury Department’s fickle Legislation.

The problem here is that no-one is truly assessing and in need fighting the complaints from DASS. The quasi legal firms that prey on these matters will exacerbate the losses for what were in a lot of cases wholesale clients and with AFCA’s make it better than it should be “what if”scenarios the amount of the losses to be borne by Industry participants that had nothing to do with the loss and couldn’t have ameliorated the losses themselves will force them out of the market. The likely cost of the CSLR levy will wipe out the profits of many advisers who are already struggling to survive.

I also am gravely concerned that off the back of sentiment against the Institutions we are now seeing Legislation in hindsight because nobody is willing to stand up and say that it was not the fault of the IFA’s that DASS promoted greed returns, where was ASIC in this? As usual ASIC is missing in the fight but looks to bayonet the wouneded (in this case all the IFA’s that have done the right thing).